Table of Contents

ToggleAcross the UAE, KSA, and Qatar, Ramadan isn’t just a spiritual month; it’s the most significant behavioural transformation of the year.

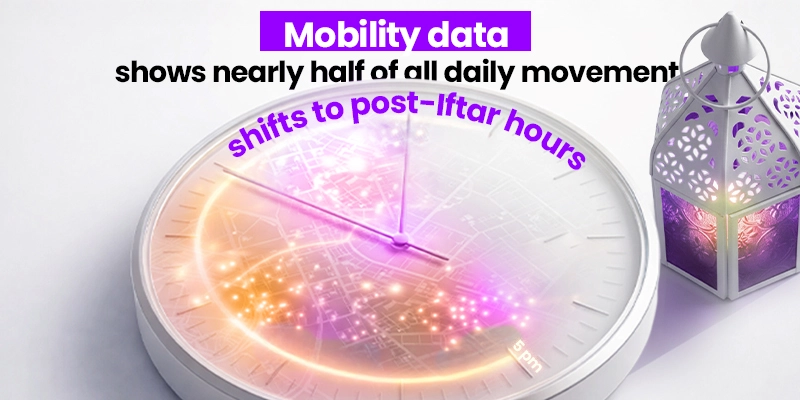

And this year, mobility data reveals a truth every marketer must face:

Ramadan has become a night-time economy.

And real-world movement predicts consumer demand before digital signals do.

This isn’t a trend. It is no longer a predictable four-week cycle of night-time activity, mall surges, and late-evening food runs.

What Changes in Consumer Behaviour During Ramadan in the GCC?

Ramadan shifts how people move, shop, eat, gather, travel, and spend.

Real movement patterns across the UAE, Saudi Arabia, and Qatar show a more complex, behaviour-driven landscape, one where intent can be read hours, days, and sometimes weeks before traditional signals appear.

Did you know?

More than 48% of daily movement during Ramadan in the GCC happens after Iftar, compared to 18–22% on regular days.

Mobility reveals:

- Earlier days, later nights

- Compressed work hours

- More family time

- Different shopping windows

- Different spending triggers

For brands, the question is not “How big is Ramadan?” but “Where does real behaviour shift, and how do we show up at the right moment?”

Understanding these real behavioural changes is essential, especially in a year when Ramadan 2026 will be more mobile-driven, more e-commerce-heavy, and more digitally active than ever.

At MEmob+, we decode this through mobility intelligence, affirming that: Behaviour changes physically before it changes digitally. Our analysis, based on billions of AllPings signals, focuses on real-world movement across the UAE, KSA, and Qatar. It focuses on how people actually behave: where they go, when they go, and what their patterns tell us about intent, priorities, and opportunity.

The Ramadan Clock: Hour-by-Hour UAE, KSA, Qatar Behaviour

- The Pre-Iftar Quiet Period (3–6 PM): This period shows a noticeable decline in movement across all three markets, but it is not inactivity; it is purposeful activity. People make fewer trips, but each trip is driven by necessity: groceries and last-minute essentials, desserts, gifting pick-ups, pharmacy visits, and quick visits to nearby malls or local stores.

- Iftar-to-Taraweeh Movement (6:30–10 PM): This is the most socially expressive period of the day. Families move, meet, gather, and visit restaurants or each other’s homes. Visits are driven less by consumption and more by social connection. Brands that show up here win awareness but not necessarily conversion.

- Late-Night Revival (10 PM–2 AM): The late-night economy becomes the backbone of Ramadan. Movement spikes again, especially among younger audiences. What rises in this late-night block: Gyms and fitness centres, dessert shops and cafés, gaming lounges, convenience stores, drive-thru F&B outlets.

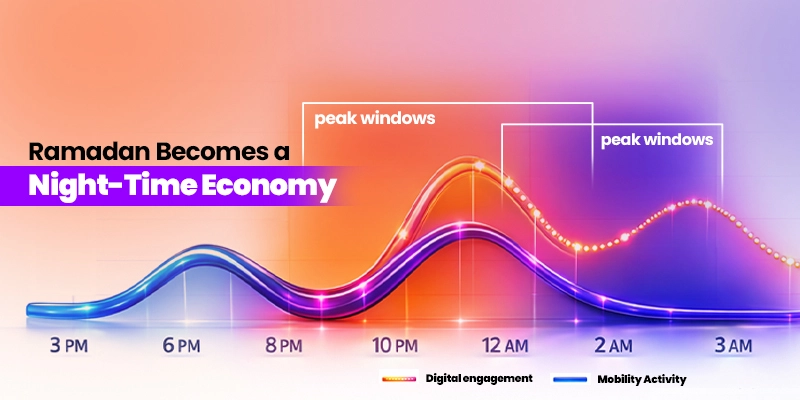

Ramadan Becomes a Night-Time Economy

The most striking shift is the move toward a nocturnal economy. The bulk of digital browsing, shopping, and decision-making happens between 8 PM and 2 AM, a complete reversal of typical consumer behaviour.

- 48% of activity happens after iftar.

- 38% of engagement occurs after the Taraweeh prayers, and 24% peaks before suhoor. Campaign Middle East+1

- Highest order volumes occur between 12 AM and 3 AM (DHL+1).

GCC Pre-Ramadan Behaviour: When Does Shopping Actually Start?

Early Shopping Intent Signals: Groceries, Food & Gifting Trends

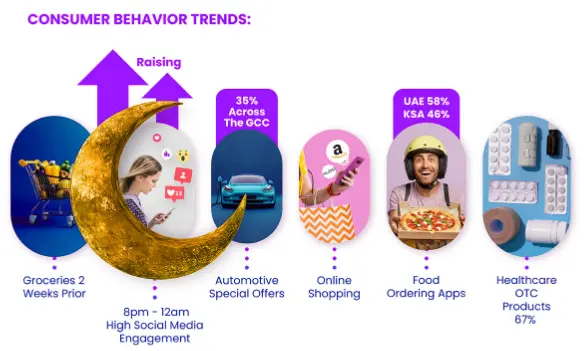

Ramadan shopping does not start when retailers think it does. Nor does it follow search trends or promotional calendars. Consumer movement shows that intent appears earlier across several categories.

Grocery Shopping Begins 5–12 Days Before Promotions:

While brands typically launch offers in the first week, mobility reveals footfall uplift earlier; people begin preparing home supplies, oils, spices, dry goods, and beverages well before marketing campaigns begin. Their movement is quiet but consistent, reflecting long-term planning.

Gifting Moves In the First Week, Not the Last:

Dessert shops, chocolate stores, and gift categories show an early uplift.

Two clear behaviours stand out:

- High-income households start gifting earlier.

- Families prepare gifts for relatives and neighbours during the early days of Ramadan, not just on Eid.

This behaviour is culturally rooted and consistent across the UAE, KSA, and Qatar.

Food & F&B Follow a Three-Wave Daily Pattern

- Pre-Iftar errands

- Iftar dining and family gatherings

- Late-night F&B for youth and younger professionals

These three waves create distinct consumption micro-moments, each with its own movement signature.

Ramadan E-Commerce Surge

Ramadan is the peak e-commerce season in the GCC, characterized by a significant surge in online activity and specific consumer behavior patterns.

- E-commerce rises 30–50% during Ramadan compared to baseline months. DHL+1

- In Saudi Arabia, transaction volumes increase 35–40%. Arab News

- Middle East & North Africa (MENA) data confirms strong growth: in 2024, transactions rose ~23%, and GMV (gross merchandise value) increased ~13%. Khaleej Times+1

- Demand for gifting, especially online, jumps significantly. Khaleej Times+1

Mobility data & insights reveal:

- Certain neighbourhoods, especially households, high-income, or expatriate areas, show early browsing behaviour, even 5–7 days before major sales.

- Footfall hotspots at night often correlate with high delivery density, meaning people browse in malls or local areas, then order home delivery from the same location.

- Gifting behaviour is concentrated in “corridor” zones connecting residential clusters and retail districts.

These patterns make timing and location critical. Evening windows, post-Iftar, post-Taraweeh, and pre-Suhoor, consistently show the highest receptivity and conversion potent

How MEmob+ Maximizes This Surge

Brands can maximize efficiency by moving beyond static media schedules and leveraging real-world movement patterns.

MEmob+’s proprietary DSP, Excelate, uses AllPings mobility intelligence to automate campaign delivery based on high-intent moments:

- Within minutes, proximity shoppers enter mall zones or commercial districts.

- Night-time economy audiences are most reachable after 10 PM when browsing peaks.

- Pre-Iftar necessity shoppers are making quick trips for essentials.

- Eid-focused shoppers, especially during mid-Ramadan spikes.

- Cross-border GCC travellers are active during key weekends.

By combining AllPings’ mobility data with Excelate’s automated bidding, pacing, and channel allocation, brands no longer rely on assumed media schedules. This alignment with real-world behaviour maximizes conversion rates, ROAS, and campaign efficiency during Ramadan’s peak e-commerce surge.

Category Surges: Home Upgrades, Fitness, Beauty, Pharmacies & the Late-Night Economy

Comfort, Home Upgrades & Electronics:

Ramadan is increasingly becoming a month of home improvement and long-term investment. Beyond spiritual rituals, consumers upgrade their living spaces for comfort, hosting, and family gatherings.

Market indicators show this shift clearly:

- ~40% of UAE consumers consider buying electronics during Ramadan, with ~24% actively browsing (MENA Search Awards).

Mobility patterns confirm it:

- Evening visits to electronics and appliance stores spike, especially mid-Ramadan.

- Families visit together after Taraweeh or during late-night shopping blocks.

- Home-improvement and lifestyle stores show longer dwell times compared to regular weekends.

For electronics and home brands, Ramadan isn’t a flash sale moment; it’s a “renewal mindset.” Messaging must focus on long-term value, home readiness, comfort, and togetherness, not just discounts.

Ramadan creates category-specific behaviour shifts that challenge traditional assumptions.

Fitness: The Late-Night Spike

One of the clearest mobility patterns is the Ramadan fitness surge after 10 PM.

Gym visits in Dubai, Riyadh, Doha peak between 10 PM and 1 AM, led primarily by:

- Youth

- Young professionals

- High-income segments

Gyms are among the most resilient categories during Ramadan, with consistent movement even on weekdays.

Beauty & Personal Care: A Pre-Iftar Story

Contrary to popular belief, beauty store and salon visits peak before Iftar , not at night.

Reasons include:

- Preparation for gatherings

- Pre-Iftar salon bookings

- Families preparing for social events

- Errands completed before evening crowds

Beauty is a daytime intent category during Ramadan.

Pharmacies: The Hidden Convenience Hub

Pharmacies see stronger Ramadan traffic because they function as mini convenience stores.

Movement increases for:

- Hydration products

- Supplements

- Skincare

- Quick snacks

- Last-minute essentials

Neighbourhood pharmacies outperform large-format supermarkets in Ramadan convenience needs.

Late-Night F&B: The Youth-Led Economy

The late-night window drives:

- Dessert shop visits

- Drive-thru F&B

- Shisha cafés

- Gaming cafés

- 24-hour bakeries

This is the most commercially active period for youth-led brands across GCC cities.

Screens Replace Shopping Bags: Video & CTV Rise in Ramadan Rituals

As the day winds down, Ramadan evenings increasingly revolve around entertainment, screen time, and family gatherings, making video and mobile channels crucial.

- Video Dominates: Engagement with short-form video soars (+32% in KSA, +28% in UAE). A massive 76% of MENA consumers agree that technology enhances their Ramadan experience. Campaign Middle East.

- The Second-Screen Moment: Late at night, especially after evening prayers, “second-screen behavior” peaks. People are gathered, relaxed, browsing social feeds, watching Connected TV (CTV), or consuming short videos, often moments before placing an impulsive order.

- Impulse Rules: Shopping in these late-night windows is typically lighter, more impulsive, and emotionally driven, moving away from planned, daytime purchases.

During the intimate, screen-attentive moments of Ramadan evenings, loud, aggressive sales campaigns are simply ineffective. The modern marketer must embrace a strategic shift: integrating Soft Storytelling with Hard, Data-Driven Targeting.

This successful approach requires brands to:

- Connect Emotionally: Use culturally resonant visuals and short-form video to build a connection.

- Target Precisely: Leverage AllPings Mobility Intelligence to ensure content reaches consumers at the exact right time and place, moving beyond demographic targeting to predict high-intent moments.

This precision allows campaigns to activate critical, high-value audiences successfully:

- Targeting the “Need It Now” Shopper: Reaching them the moment they enter a commercial area or mall zone.

- Reaching the Night Owl: Delivering ads precisely after 10 PM when screen time and browsing activity peak late into the night.

- Capturing the Pre-If

- Time-Based Relevance: Creative variants instantly adapt based on the critical windows: After Iftar, After Taraweeh, and Pre-Suhoor, even adjusting for differences between weekday and weekend behavior.

- Movement-Triggered Personalization: Using AllPings location intelligence, Blueprint adapts ads based on the consumer’s live location: proximity to stores, footfall density, location type (e.g., mall vs. café district), or audience lifestyle movement.

- Product-Level Customization: Blueprint personalizes the offer, adjusting the SKU/category, pricing, specific car models, or local promotions based on city-level variations.

Blueprint: Creative Intelligence Built for Ramadan Attention Peaks

Ramadan’s fragmented screen-time means creatives must adapt to the moment. This is where Blueprint comes in, combining rich media and Dynamic Creative Optimization (DCO) to make every impression contextual and relevant.

Blueprint acts as a Ramadan-specific creative intelligence engine, ensuring your message is always impactful and personal.

Dynamic Creative Optimization (DCO) for Every Moment

Your ad copy and visuals automatically switch based on the consumer’s context, no manual intervention required: gamified ads, swipeable car models, and dynamic product showcases, all built for high engagement during the late-night browsing window.

Furthermore, with In-Ad Measurement using Stretch, you gain transparency, seeing exactly which creative variant drove measurable results like store visits or engagement, eliminating all guesswork.

Eid Shopping: Why the Last-Minute Misconception is Costing You Millions

The biggest, most costly misconception in GCC retail is that Eid shopping is a last-minute rush.

The Reality: Mobility data strongly contradicts this. By waiting until the final week of Ramadan to launch Eid campaigns, brands miss the crucial first wave of high-value planners, early-gift buyers, and high-income shoppers who drive the season’s success.

Misconception | Mobility Reality |

Shopping peaks only in the final 10 days. | The final 10 days are peak execution, but decisions are made mid-month. |

All categories start at the same time. | Browsing for Fashion, Perfumes, and Cosmetics starts as early as Day 7–12 of Ramadan. |

Last-minute deals drive the whole season. | High-spending families and tailoring-driven audiences shop weeks in advance to avoid crowds. |

The Early Surge: When Real Eid Intent Begins

The data proves that the Eid economy starts much earlier, with intent building across key categories mid-Ramadan:

- Fashion & Beauty: Browsing for fashion starts around Day 7–10, with perfumes and cosmetics visits rising by Day 10–12.

- Electronics & Gifting: Footfall in electronics stores and planning for gift-related purchases begins around Day 12–16 (mid-Ramadan).

Key Regional Patterns:

- KSA Leads the Charge: Saudi shoppers exhibit the earliest intent due to larger family gifting, tailoring needs, and longer preparation cycles. Gold souqs and fashion districts in Riyadh and Jeddah show strong mid-Ramadan spikes.

- UAE’s Two-Peak Pattern: Dubai and Abu Dhabi show an initial mid-Ramadan uplift, followed by a stronger late-Ramadan surge often driven by premium malls, tourists, and high-income residents.

- Qatar’s High-Value Burst: The window is tighter, but the purchases are bigger. Luxury categories see peak performance during this concentrated, high-value period.

2026 Tactical Playbook: Movement, Not Assumptions

Brands that succeed in Ramadan 2026 will be those that understand how people move before they search. This requires a strategy built on real-world behavior:

- Start Early (Day 1): Target early planners immediately with messaging focused on home preparation, essentials, and early gifting.

- Segment by Behavior: Abandon traditional demographics. Use mobility-based audience clusters like ‘night-owls,’ ‘early-interest segments,’ and ‘cross-border travelers’ for precise activation.

- Time Media to Ramadan Rhythms: Shift budgets, bids, and dynamic creative delivery to the periods of highest consumer receptivity: post-Iftar, post-Taraweeh, and late-night windows.

- Optimize the Channel Mix: Utilize a layered approach: mobile, in-app, CTV after Taraweeh, and DOOH near malls (where browsing occurs) coupled with late-night delivery-app promos.

- Tailor Creative Contextually:

- Early Ramadan: Home-preparation promos.

- Mid-Ramadan: Gifting and lifestyle creative.

- Final Days: Urgency and specific deals.

- Measure Real-World Outcomes: Attribute properly by using footfall and conversion-based metrics (not vanity metrics like clicks/impressions) to understand actual sales impact.

Conclusion: Ramadan 2026 Is About Movement, Not Assumptions

Ramadan is no longer a static four-week period. It is a mobility-driven, digitally amplified, night-centric cultural moment. The perception of “last-minute Eid shopping” is outdated because movement reveals the truth: When Eid shopping truly starts, how cross-border travel shapes consumption, and which malls drive visibility versus conversion.

Brands that succeed in 2026 will be those that:

Data: Predict Demand Through Mobility Patterns

- Predict intent by understanding movement before search.

- Identify when households prepare, shop, and gather.

- Map the night-time economy, especially youth behaviour.

- Distinguish which malls drive awareness vs. conversion.

- Track the true start of Eid shopping (mid-Ramadan).

- Factor in cross-border travel and loyalty to familiar districts.

Activation: Engage Consumers When It Matters Most

- Trigger campaigns at post-Iftar, post-Taraweeh, or entry into high-intent zones.

- Use Blueprint to adapt creatives instantly to time, place, and mood.

- Prioritize mobile, in-app, and CTV, where evening attention peaks.

Measurement: Track ROI From Exposure to Conversion

- Measure what matters: footfall, conversions, and verified outcomes, not clicks.

- Close the loop with metrics that link digital spend to physical and e-commerce sale

You no longer need to guess. With the MEmob+ stack, powered by AllPings (data), activated by Excelate (bidding), made relevant by Blueprint (creative), and measured by Stretch (measurement), you can see, plan, activate, and measure with precision.

Ramadan 2026 will be more mobile-led, more night-driven, and more intent-rich than previous years. Understanding it starts with understanding mobility, the clearest indicator of real human behavior.

FAQs: Ramadan Mobility & Commerce

Q: When are people most active during Ramadan?

A: Between 8 PM and 3 AM, especially post-Iftar and leading up to suhoor. Delivery volume and footfall both peak in that window.

Q: Which categories outperform during Ramadan?

A: Gifting, electronics, home goods, beauty, food delivery, groceries, wellness, entertainment, and digital finance.

Q: Why does mobility matter more than static demographic data during Ramadan?

A: Because Ramadan behaviour reorganises when people move, not necessarily who. Mobility data captures those shifts in real time, enabling precision.

Q: Is mobile really the dominant channel?

A: Yes. In many markets, over 90% of Ramadan e-commerce transactions are mobile-led.

Q: How can brands measure Ramadan’s real impact?

A: Use a combination of mobility signals (footfall, delivery density, heatmaps) + digital analytics + post-campaign attribution (with tools like Stretch) to connect exposure → movement → conversion