Table of Contents

ToggleThe Inconvenient Truth: Why Marketing Effectiveness in MENA Is Misread by ROAS Alone

Marketing has spent a decade optimizing what fits neatly into a dashboard. We have become exceptionally good at capturing attention in digital environments, and even better at proving that we did.

It looks scientific. It feels defensible. It is usually the easiest story to tell in a boardroom.

But here is what C-suites are increasingly asking, and what too few teams can answer with confidence:

- Are we measuring effectiveness, or are we auditing vanity?

- Did any of that move the business?

Attention is not action. What many teams celebrate as “performance” is often a Digital Mirage: performance that looks strong on a screen, while the link to tangible business outcomes remains partial, delayed, or unknown.

A consumer can like, share, save, comment, and click without changing real-world behavior. They can be “highly engaged” and still never walk into a store, choose a brand at the shelf, or switch from a competitor.

This is rarely a failure of creativity or execution. It is a measurement blind spot.

What is Digital Mirage?

The Digital Mirage occurs when marketing appears successful based on impressions, clicks, and engagement, but the link to real outcomes remains unclear. In GCC markets where much of the value is still captured offline, effectiveness requires connecting exposure to intent, mobility, store visits, and incrementality, then optimizing budget against footfall and market share, not vanity metrics.

The inconvenient truth MENA marketers cannot ignore

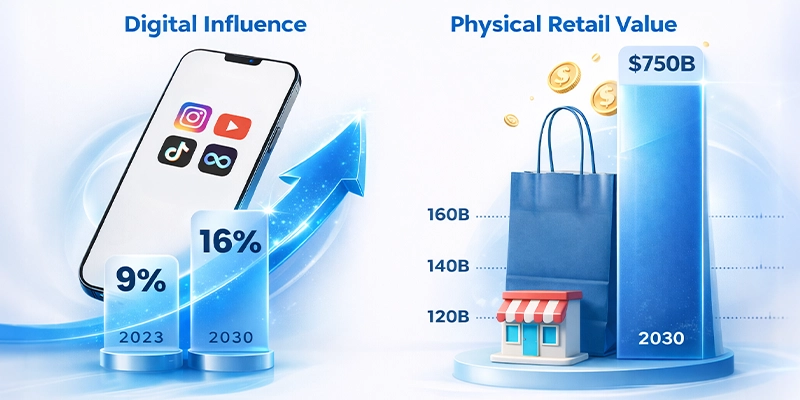

In 2026, the effectiveness gap becomes unacceptable, especially across the UAE, KSA, and Qatar. These markets are not “digital-only.” They are physical economies with digital influence.

Redseer estimates MENA’s online retail penetration at 9% in 2024, growing to 16% by 2030, within a roughly $750B retail landscape. (Source: Redseer). That means the majority of value still happens offline, even as attention shifts online.

Read that again.

Even with growth, most value is still captured offline. Which means if your measurement ends at the screen, you are optimizing for the wrong finish line.

Why 2026 is different: budgets are scaling faster than measurement quality

Digital spend in the region is accelerating.

IAB MENA reports $6.95B in MENA digital advertising spend in 2024, up 19.8% year on year. (Source: Campaign Middle East, IAB MENA).

At the same time, Strategy& (PwC) expects MENA’s media and entertainment market to grow to $18B by 2028, with digital’s share rising from 71% to 74% in that period. They also forecast advertising revenue growth of 7.4%. (PwC). Download for more information: MENA media and Entertainment Outlook, 2024 – 2028.

This is the context for 2026:

- More money is going into digital.

- Digital influence is expanding.

- Offline value still dominates many categories.

- Measurement has to evolve, or the “effectiveness gap” will widen.

At this scale, tiny inefficiencies become large financial outcomes. A few points of wasted reach, duplicated frequency, or low-quality delivery can represent tens of millions in ineffective spend.

This leads us to what can be called the Engagement Paradox.

Massive digital interaction does not always translate into measurable real-world action.

- Brands today can achieve millions of impressions without moving a single consumer closer to a point of sale.

- Campaigns can trend online while footfall remains flat.

- Awareness can spike while market share stagnates.

The real issue is partial observability, not weak creative

Most marketing stacks optimize for what they can easily see:

- Impressions

- Clicks

- View-Through Metrics

- Platform Conversions Inside Walled Ecosystems

That works fine when the conversion happens online.

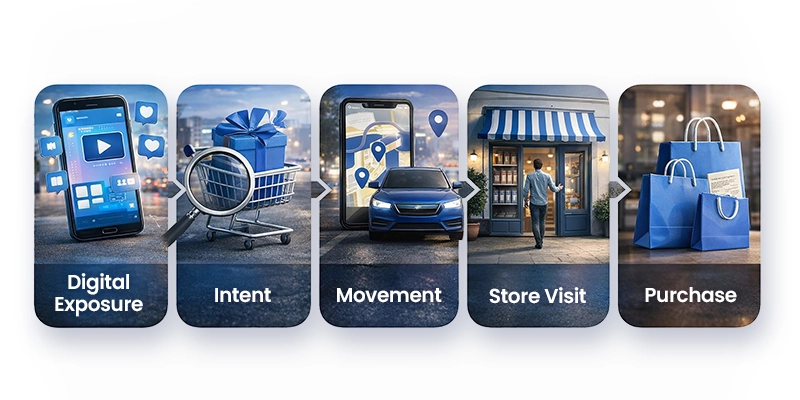

But in physical-first categories (retail, QSR, FMCG, automotive, telecom, banking branches, hospitality), the actual journey often looks like this:

These are sectors where growth is not won in feeds, but in stores, branches, showrooms, and physical moments of choice.

If we cannot confidently answer questions like:

- Did this campaign increase store visits?

- Did it shift traffic away from competitors?

- Did it influence real movement and behavior?

Then we are not measuring effectiveness. We are measuring activity.

Traditional reporting captures the first step and estimates the rest. This creates three predictable failures:

- Proxy-optimization: Budgets get optimized toward CTR, VCR, and engagement, even when those metrics do not reliably correlate with visits or sales.

- Budget leakage: Spend bleeds into low-quality delivery, duplicated reach, and long-tail inventory, where “scale” inflates numbers but not outcomes.

- Strategic misallocation: Planning ignores travel realities, competitor adjacency, and true store catchment areas.

If you want the C-suite definition, it’s simple:

“You cannot manage what you cannot observe. In 2026, effectiveness is not a creative refresh. It is an observability upgrade.”

A hard number that should change how you interpret “digital performance”

A lot of what gets reported as “performance” is still just delivery.

The ANA Programmatic Transparency Benchmark (Q1 2025) reported that participants directed 41% of programmatic budgets to “effective ad impressions” under its quality definitions. (Source: ANA Programmatic Transparency Benchmark).

The leadership takeaway is not the exact percentage. It’s what it implies:

- A low CPM is not a win if the impression is not effective.

- A high CTR is not a win if delivery is duplicated, low-quality, or non-human.

- Optimization is risky when it learns from polluted signals.

This is why 2026 should be the year marketing moves from vanity metrics to quality-qualified delivery and outcome-based measurement.

Fraud and low-quality supply are not edge cases. They are systemic risks to measurement.

Juniper Research estimates global ad fraud losses at $84B in 2023, projecting that figure could rise to roughly $170B to $172B by 2028. (Source: Search Engine Land).

This matters for effectiveness because fraud is not only wasted spending. It is signal contamination:

- It inflates impressions, clicks, and engagement

- It trains algorithms to favor a cheap, noisy supply

- It rewards the mirage because dashboards look “better.”

Your marketing engine becomes very good at optimizing what is easiest to deliver, not what drives outcomes.

Even on major platforms, quality risk is not theoretical. A Reuters investigation reported internal estimates that Meta projected about 10% of its 2024 revenue, around $16B, could come from advertising scams and banned content. (Source: Reuters).

The takeaway is operational, not platform-specific: Effectiveness requires independent outcome measurement that does not rely solely on self-reported engagement.

MENA’s physical reality is measurable, and it should reshape planning

In MENA, physical movement patterns are not random. They are routine-driven, time-bound, and location-anchored.

A Nielsen survey reported in the regional press showed:

- 76% of Dubai mall trips occur between 5 pm and midnight

- 32% of respondents visit at least once a week. (Source: Campaign Middle East).

This single data point should change how you plan, optimize, and execute:

- Dayparting is not cosmetic. It is aligned with conversion windows.

- Geo decisions should change by time-of-day, not only by a static location pin.

- Frequency should be concentrated into windows of physical intent, not spread evenly across a 24-hour cycle.

If your measurement layer cannot see mobility, it will misinterpret what is working and why.

The Question That Changes the Conversation

At some point, every serious marketer arrives at a critical inflection point:

What if the most effective dollar isn’t spent on amplifying another message, but on understanding where customers actually are?

- Where they live.

- Where they work.

- Where they commute.

- Where they shop.

- Where they hesitate.

- Where they choose one brand over another.

What if effectiveness is not about shouting louder, but about showing up at the right physical moment?

This question forces a shift from digital performance as an end goal to digital performance as a bridge to the physical world.

Beyond Digital vs. Physical: The Need for Unification

This is not an argument against digital marketing. Nor is it a call to return to traditional media.

The future of effectiveness lies in unification.

Digital channels remain unmatched in scale, speed, and personalization. But physical behavior remains the ultimate proof of impact. The real opportunity is not choosing between the two, but connecting them.

This requires evolving beyond demographic targeting and interest segments into a more advanced philosophy: Location Intelligence.

Definition: Location Intelligence, The Missing Layer in Measuring Real Marketing Effectiveness

Location intelligence is the use of privacy-safe mobility signals and geospatial analytics to understand real-world behavior, define reachable catchments, build behavior-based audiences, activate media with precision, and measure incremental outcomes.

It acknowledges a simple truth:

Consumers do not live inside personas. They live inside places.

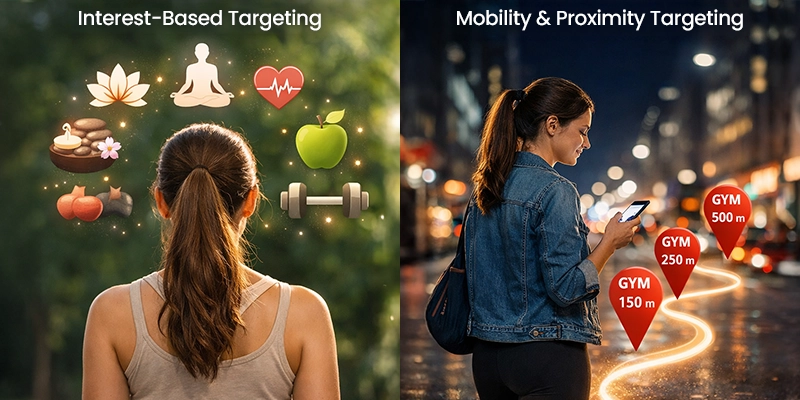

- Targeting “a 35-year-old female interested in wellness” is a start.

- Targeting her when she is physically in a decision moment, such as walking past a competitor studio, entering a mall corridor, or approaching a retail cluster in Riyadh, Jeddah, Dubai, or Doha, is a different class of effectiveness.

Why radius targeting is not the problem, radius-only thinking is

Most marketers start with a radius. That’s fine. The mistake is treating that circle as the trade area.

It ignores the variables that drive physical conversion:

- road networks and congestion

- barriers and walkability

- parking friction and corridor accessibility

- The difference between “near” and “convenient.”

- The fact that 10 minutes by car is not symmetric in all directions

A radius is a starting boundary, not a conversion model. It does not know what matters in physical conversion:

- How long does it take to reach the store

- Which routes do people actually use

- Which competitor sits in the same corridor

- Whether two branches are cannibalizing each other

- Whether ads created incremental visits or just re-targeted people who would come anyway

So the circle does two expensive things simultaneously:

- It includes people who are technically nearby but practically unlikely to visit.

- It excludes people outside the radius who are actually reachable and have high intent.

The 2026 Upgrade: Radius + Travel-Time + Mobility Reality

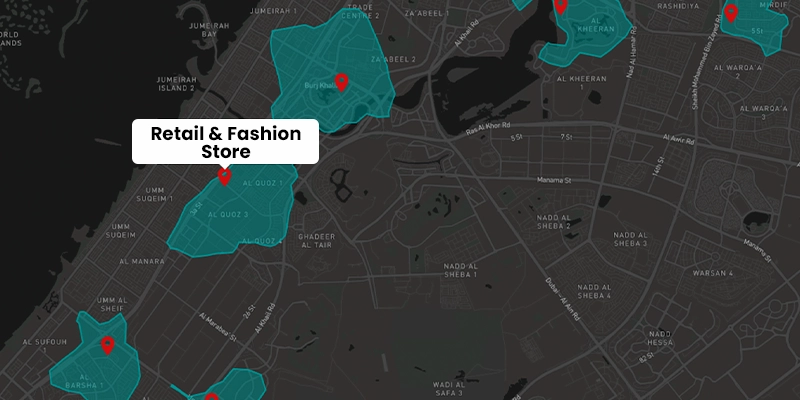

What MEmob+ actually does: it does not replace radius, it upgrades it into an outcome system

This is the critical correction: Radius is a baseline boundary. MEmob+ turns it into a conversion-grade model by layering travel-time reach, mobility reality, precision activation, and incrementality measurement.

Travel-time catchments

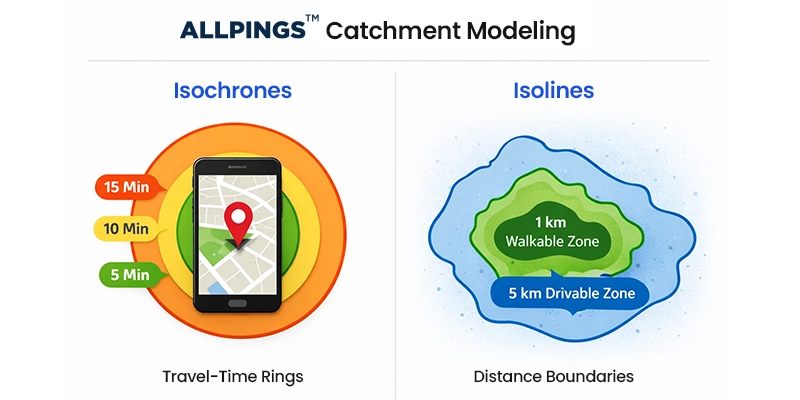

Using AllPings catchment modeling, MEmob+ builds trade areas as:

- Isochrones (time-based reach): who can reach a location in 5, 10, 15 minutes, by drive or walk

- Isolines (distance-based boundaries): useful as a secondary constraint where needed

This allows you to define practical zones such as:

- a 1 km walkable catchment

- a 5 km drivable catchment

- plus additional travel-time tiers for smarter bidding and messaging

Then, instead of treating reach as static, AllPings strengthens it with mobility signal depth:

- GPS and network-derived location signals (including triangulation)

- time-stamped mobility sequences to surface high-intent micro-moments

- predictive timing patterns to identify when a cohort is most likely to convert

The result: reachable audiences, not just nearby audiences.

Mobility Patterns:

AllPings overlays observed movement patterns on those catchments to identify-

- Who actually flows through the zone?

- How often do they pass?

- What time windows does the zone peak?

- Which competitor locations do they frequent?

- How do routines cluster into corridors and trip chains?

Examples of segments that are measurable and operational:

- “Visited competitor X twice in the last 14 days.”

- “Frequent mall visitors within a 10-minute drive-time catchment.”

- “Hypermarket errand runners, weekday evenings.”

- “Gym-to-cafe routine cohort near competitor cluster.”

This replaces assumption with evidence. It also reduces waste, because audiences become behavior-defined.

Precision programmatic activation:

Excelate DSP activates using that location intelligence with execution controls that reduce duplication and wasted frequency:

- Bidding and frequency by travel-time tier

- Daypart and corridor-aware targeting aligned to physical intent windows

- Competitor conquest zones built from actual adjacency, not guessed proximity

Incrementality measurement:

Stretch closes the loop with incrementality-first measurement, shifting reporting from “activity” to “impact”:

- incremental visit lift, not raw visit counts

- cost per incremental visit

- store-level and zone-level contribution

- competitor share-of-trips shifts

This is the layer that makes the system accountable. It proves whether the spend moved real behavior, not just metrics.

Leadership sentence

MEmob+ turns radius targeting into an effectiveness system by combining travel-time catchments, real mobility behavior, precision activation, and incrementality measurement, so budget follows reachable demand and impact is proven at the store and zone level.

From Exposure to Movement: Measuring What Actually Matters

Ultimately, the goal of marketing has never changed:

Did the campaign drive action?

Digital platforms can confidently tell us:

- How many saw an ad

- How many clicked

- How many watched

- How many engaged

But real growth requires a deeper answer:

- Who moved?

Audience mobility and footfall attribution connect spend to outcomes by linking exposure, movement patterns, and store visitation at an aggregated, privacy-safe level.

This enables leadership questions that marketing must answer in 2026:

- Did exposed users visit more than a comparable control?

- How long after exposure did visitation occur?

- Which zones and branches benefited?

- Which competitor locations lost traffic when measured in a defensible framework?

This is the shift from vanity metrics to verifiable impact.

Competitive conquesting becomes measurable

One of the most powerful applications of Location Intelligence is competitive conquesting.

Instead of targeting broad audiences who might be in the market, brands can:

- Identify frequent visitors to competitor locations

- Understand their movement patterns

- Engage them at moments of physical proximity or decision

This transforms competition from a branding exercise into a strategic spatial battle.

Marketing stops being abstract and becomes territorial, in the most intelligent sense of the word.

Why This Matters More in Emerging & Hybrid Markets in GCC

In the UAE, KSA, and Qatar, particularly across emerging and hybrid economies, the gap between digital behavior and physical commerce remains wide.

Consumers may:

- Discover brands online

- Research digitally

- Engage socially

But the final decision still happens offline.

Ignoring physical behavior in these markets doesn’t just limit insight; it actively misrepresents reality.

Marketers who rely solely on digital KPIs risk overestimating success while underdelivering on growth.

The End of the Mirage

The Digital Mirage is not deception; it’s incompleteness.

Digital metrics are real, useful, and necessary. But they are not sufficient on their own.

True effectiveness demands:

- Understanding where people go

- Why do they go there

- What influences that movement

- And how marketing can shape it

When we measure movement instead of just interaction, something changes. Marketing becomes accountable. Strategy becomes grounded. Creativity becomes consequential.

We stop celebrating the movement of thumbs and start measuring the movement of people.

The New Question for Marketing Leaders

The most important question facing modern marketers is no longer:

“How loud is our digital voice?”

It is:

“How far does our marketing move the real world?”

Those who can answer that question with confidence won’t just win attention.

They’ll win behavior, preference, and growth.

True effectiveness demands proof of physical impact, measurable footfall, incremental behavior, and defensible ROI. Location intelligence is no longer an enhancement to digital strategy; it is the measurement layer that separates activity from effectiveness, and perception from reality.

Privacy and compliance note for UAE, KSA, and Qatar

Location intelligence and measurement must operate within regional data privacy expectations.

- UAE has a federal personal data protection framework under Federal Decree-Law No. 45 of 2021.

- Saudi Arabia’s PDPL became fully enforceable from 14 September 2024, with enforcement led by SDAIA.

- Qatar’s Law No. 13 of 2016 concerns the protection of personal data privacy.

MEmob+ approaches this through privacy-safe aggregation, governance, and reporting that is designed for measurement and planning without exposing identity-level movement histories.

FAQ

- What is the “Digital Mirage” in marketing?

It is when marketing looks successful through impressions, clicks, and engagement, but the connection to store visits, purchases, or market share remains unclear.

- What is footfall attribution?

A measurement approach that evaluates whether digital exposure led to physical store visitation using aggregated mobility insights, paired with controls to estimate incrementality.

- What is an isochrone, and why is it better than radius targeting?

An isochrone is a travel-time map showing what is reachable within a time threshold by a mode of transport. It aligns reach with convenience, not geometry, which improves planning for physical outcomes.

- Why did Meta radius targeting become less precise for “locals only” use cases?

Meta removed the location targeting dropdown that allowed “living in” vs “recently in” vs “traveling in.” Advertisers were left with “living in or recently in,” which can include transient audiences.

- How do you reduce audience duplication across Meta, video, and programmatic?

By anchoring planning on a shared outcome such as incremental visits, applying frequency discipline by cohort, and using suppression and pacing logic so the same devices are not overserved across channels.

- What metrics should C-suites demand in 2026?

Incremental visit lift, cost per incremental visit, branch and zone contribution, and quality-qualified delivery rates, not only CPM, CTR, or engagement.

- How should CMOs measure marketing effectiveness beyond ROAS?

CMOs should evaluate marketing effectiveness by linking digital exposure to verified physical outcomes such as footfall, sales lift, and market share growth, rather than relying on ROAS in isolation.

- Why is footfall critical to evaluating digital campaign effectiveness?

Footfall confirms whether digital impressions influenced real-world behavior, allowing brands to distinguish between passive engagement and genuine consumer action.

- How does location intelligence improve marketing effectiveness?

Location intelligence provides visibility into real consumer movement, enabling marketers to measure incrementality, eliminate wasted reach, and connect media spend to physical outcomes.

References

- Redseer: MENA online retail penetration 9% (2024) to 16% (2030) within a $750B retail landscape

- IAB MENA: MENA digital ad spend $6.95B in 2024, up 19.8% YoY

- Strategy& (PwC): MENA media and entertainment outlook 2024–2028, market to $18B by 2028, digital share 71% to 74%, ad revenue growth 7.4%

- MEmob+: The Ultimate Guide to Location Intelligence in GCC

- ANA: Programmatic Transparency Benchmark Q1 2025, 41% directed to “effective ad impressions.”

- Juniper Research estimates reported by Search Engine Land and PRNewswire: ad fraud $84B in 2023, projected to be about $170B by 2028

- MEmob+: How isoline mapping is reshaping QSR marketing in the MENA region

- Reuters investigation: Meta’s internal estimate about 10% of 2024 revenue ($16B) linked to scam and banned-content ads

- Nielsen survey coverage: Dubai mall visits, 76% between 5 pm and midnight, 32% at least weekly

- MEmob+: How to define precise customer locations using the isochrones tool

- UAE PDPL overview and official platform references

- Saudi PDPL enforceability timing