Table of Contents

ToggleFor centuries, summer has fueled travel, especially in the Gulf Cooperation Council (GCC)—Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman, from pilgrimages to modern luxury escapes.

As summer fuels a 15.2% surge in outbound tourism, marketers have a golden opportunity to capture affluent travelers spending $2,000–$3,500 per trip (Source: Visit Dubai, 2024 Tourism Report).

“GCC travelers are redefining luxury tourism, blending opulence with authenticity,” says Elena Petrova, Director of Global Tourism Partnerships at Visit Dubai.

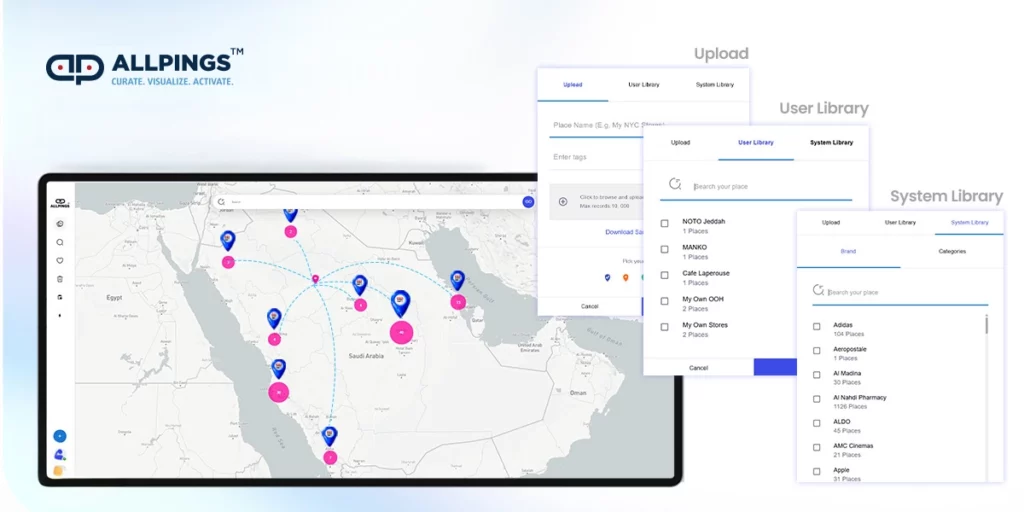

Published by MEmob+, this blog leverages our proprietary AdTech and AllPings’ location-based SaaS platform to unveil 2025 GCC travel insights.

We outline strategies for sectors such as hospitality, retail, aviation, QSR, and entertainment to target in-market and intended tourists, utilizing methodologies such as isoline mapping, geotargeting, geofencing, psychographic segmentation, and deterministic audience building to drive conversions.

Why Summer 2025 Is Your $70.5B Opportunity

Summer 2025 is the peak season for GCC outbound tourism, driven by school holidays, cultural events such as Riyadh Season and Dubai Summer Surprises. The region’s outbound tourism market is expected to reach $138.1 billion by 2033 (IMARC Group), driven by rising incomes, visa relaxations (e.g., GCC’s unified tourist visa), and a 60% surge in visitors to visa-free destinations like Greece (Connecting Travel).

With 6.2 million Middle Eastern tourists visiting Europe annually (UNWTO), summer 2025 offers unmatched potential.

How Marketers can capitalize by:

- Aligning with Cultural Moments: Tap festivals like Qatar’s food events or Dubai’s shopping sales to capture festive spending.

- Targeting Families/Households: 55% of travelers vacation with their spouses, and 20% with children, driving demand for family-friendly offerings (GlobalData).

- Prioritize Luxury and Sustainability: 58% seek transformative experiences, and 30% are willing to pay a premium for eco-lodges or private villas (Sabre), reflecting ecotourism’s 14.31% compound annual growth rate (CAGR) (Fortune Business Insights).

2025 GCC Travel Buyer Insights

Spending is soaring, with UAE travelers increasing holiday budgets by 78% and Saudis by 72% year-on-year (Statista).

Key Statistics

- 58% prioritize transformative experiences.

- 30% prefer private villas or eco-lodges.

- 28% plan at least one overseas trip annually.

- 32% of Saudis opt for extended holidays (3+ weeks) (Roland Berger).

- Average trip duration: 15 nights, with 35% lasting 17+ nights.

- 70% book flights online; 68% book accommodations online (Kody Technolab).

- 60% use credit cards; 28% prefer digital wallets or cash.

Booking Trends:

- 66% Hotels

- 26% Airbnb/short-term rentals

- 72% book via travel agencies.

- 55% use mobile devices.

Booking Preferences:

- 68% favor 5-star hotels.

- 20% choose 4-star hotels.

Top Destinations for GCC Travelers

- Morocco: SoukGCC travelers seek destinations blending luxury, culture, and nature.Based on Connecting Travel’s 2024 Outbound Report, the top five destinations are:

- Switzerland: Alpine vistas and wellness retreats.

- UAE: 38%

- Saudi Arabia: 36%

- Qatar/Kuwait: 14%

- Bahrain/Oman: 8%.

- Spain: Beaches, history, and gastronomy.

- 120,000 Saudi tourists

- 150,000 UAE tourists annually.

- Greece: Ancient sites and visa-free islands.

- 60% surge in GCC visitors post-visa waiver.

- Egypt: Pyramids and Red Sea resorts.

- 30 million searches from GCC travelers.

- s and cultural richness.

- 12.5 million tourists in 2024 (GlobalData).

Traveler Distribution:

- UAE: 55%

- KSA: 25%

- Qatar: 6%

- Bahrain: 4%

- Oman: 3%

Vacation Interests Driving Demand

GCC travelers are diverse, with passions shaping their journeys (Ciklum):

- Food (25%): From Michelin-starred dining in Spain to tagines in Morocco.

- Sightseeing (12%): Landmarks like Egypt’s Pyramids.

- Adventure (8%): Hiking in Switzerland’s Alps or desert safaris.

- Shopping (35%): Luxury malls in Dubai or Paris.

Travel Companions:

- 55% travel with spouses.

- 20% with children.

- 5% solo.

Top Luxury Experiences Travelers Seek In Dubai

The most sought-after luxury experiences in Dubai center around exclusivity and pushing boundaries.

Private dining on the helipad of the Burj Al Arab remains a bucket-list experience, while desert safaris have evolved to include overnight glamping in climate-controlled luxury tents with personal chefs and astronomers.

Shopping experiences have become more personalized, with high-end malls offering VIP shopping assistants and private lounges. The Dubai Mall’s Fashion Avenue provides personal styling sessions and after-hours shopping for elite clients. Water-based luxury continues to draw travelers, from yacht cruises along Dubai Marina to the floating villas at Sea Palace by Kempinski.

Recent data indicate that luxury travelers are increasingly valuing rare experiences over material goods. This shift has led to new offerings, such as hot air balloon breakfasts over the desert, Formula 1 driving experiences, and underwater suites at Atlantis, The Palm, where floor-to-ceiling windows offer a direct view into the Ambassador Lagoon aquarium.

Struggling to reach GCC travelers? Explore a Real-World Success Story:

Saudi Tourism’s “Youngest Explorers” Campaign with MEmob+

To attract international visitors to Saudi Arabia’s cultural and natural wonders, Saudi Tourism partnered with MEmob+ for the “Saudi Arabia’s Youngest Explorers” campaign in 2024, targeting summer travelers from France, Germany, and the USA. The campaign followed Aya, an Australian traveler, and Omar, a local from Jeddah, to showcase authentic Saudi experiences.

Goals: Increase engagement, identify potential tourists, and drive traffic to Visit Saudi.

Challenges: Gauge audience interest across regions and measure content viewability to optimize performance.

Strategy: MEmob+ utilized in-depth consumer insights and market analysis to identify France, Germany, and the USA as key markets. Video ads, like “Albaha Dream” and “Riyadh Dream,” were tailored to regional preferences and delivered on optimal days (e.g., Saturdays for France, Fridays for USA) using MEmob+’s predictive analytics.

Results:

- France: Highest completion rate (81.98%) and view-through rate (99.80%), with “Albaha Dream” at 83.74%. Impressions peaked on Saturdays.

![France Creative] Visual: “Albaha Dream” video thumbnail with France flag and “Highest Completion Rate: 83.74%” circle.

Alt text: French flag with “Albaha Dream” video, highlighting 83.74% completion rate. - Germany: “Albaha Dream” led with high completion rates. Impressions peaked on Fridays, view-through rates on Mondays.

[Germany Creative] Visual: “Albaha Dream” with Germany flag and “Top Completion Rate” circle.

Alt text: German flag with “Albaha Dream” video, noting top completion rate. - USA: “Riyadh Dream” topped at 76.45% completion rate. Impressions and completions peaked on Saturdays, view-through rates on Fridays.

[USA Creative] Visual: “Riyadh Dream” with USA flag and “Top Completion Rate: 76.45%” circle.

Alt text: USA flag with “Riyadh Dream” video, highlighting 76.45% completion rate.

Phase 2 Recommendations:

- Rich Media: Add calendar CTAs for events like Riyadh Season, linking to Visit Saudi.

- Segmentation: Target frequent travelers and adventure enthusiasts.

- Personalized Ads: Deliver region-specific creatives (e.g., cultural tours for France, adventure for USA).

- Optimized Timing: Schedule ads based on peak days (e.g., Saturdays for France).

Impact: Achieved 14x engagement increase, 3x reach growth, and boosted website traffic, proving MEmob+’s data-driven approach can capture summer 2025’s GCC travel surge.

Sector-Specific Strategies for In-Market and Intended Tourists

Sectors can capture GCC travelers using tailored campaigns, leveraging MEmob+’s AdTech and AllPings’ location intelligence. Below, we outline strategies for key industries, informed by prior discussions on geomarketing and moment marketing (e.g., Dubai Shopping Festival, Summer Surprises, Back-to-School, Riyadh Season).

1. Hospitality

- Opportunity: 68% prefer 5-star hotels, and 30% seek private villas. Family travel (55% with spouses, 20% with children) drives demand.

- Strategy: Promote all-inclusive packages or wellness retreats in Switzerland and Greece. Use AllPings’ geofencing to target travelers near airports or malls, delivering ads for “family-friendly Swiss chalets” or “secluded Greek villas.” MEmob+’s psychographic data identifies luxury seekers for precise targeting.

- Example: A Dubai-based resort chain used AllPings to geo-fence the UAE’s DXB airport, targeting outbound travelers with ads for Red Sea eco-lodges, achieving a 65% higher click-through rate (AllPings case study).

2. Retail

- Opportunity: 35% prioritize shopping, flocking to malls in Dubai, Paris, and Spain. Summer events like Dubai Summer Surprises amplify foot traffic.

- Strategy: Deploy hyper-localized ads via MEmob+’s DSP, targeting shoppers in high-traffic zones (e.g., Dubai Mall). AllPings’ heatmaps identify peak shopping hours, enabling offers like “20% off luxury brands today.”

- Example: A Riyadh retailer used AllPings during Riyadh Season 2024, geo-fencing malls to deliver flash sale ads, boosting foot traffic by 30% (AllPings data).

3. Aviation

- Opportunity: 70% book flights online, with 55% using mobile devices. Extended holidays (32% of Saudis) increase demand for long-haul flights.

- Strategy: Target frequent travelers with personalized flight deals to Switzerland or Spain. AllPings’ geofarming identifies past travelers to these destinations, enabling retargeting with ads like “Fly Emirates to Zurich, 10% off.”

- Example: A GCC airline used MEmob+’s audience segmentation to target UAE travelers searching “Spain flights,” achieving a 50% conversion uplift (MEmob+ case study).

4. Quick Service Restaurants (QSR)

- Opportunity: 25% are foodies, seeking culinary experiences. Summer’s cultural events (e.g., Qatar’s food festivals) attract diners.

- Strategy: Use AllPings’ real-time geofencing to target foodies near event venues or tourist hotspots, delivering ads like “Try our Moroccan-inspired menu tonight.” MEmob+’s behavioral data identifies food enthusiasts for precise targeting.

- Example: A Doha QSR chain geo-fenced AFC Asian Cup 2025 venues, promoting meal deals to attendees, resulting in an 8% click-through rate (AllPings data).

5. Entertainment and Attractions

- Opportunity: 12% prioritize sightseeing, and 8% seek adventure, driving demand for theme parks, cultural sites, and outdoor activities.

- Strategy: Promote attractions like Switzerland’s Jungfraujoch or Egypt’s Pyramids via MEmob+’s DSP, targeting families and adventure seekers. AllPings’ geofencing captures visitors near cultural hubs, delivering ads for “skip-the-line pyramid tours.”

- Example: A Dubai theme park used AllPings during Dubai Summer Surprises 2024, targeting families near malls with “2-for-1 ticket” ads, increasing visits by 25%.

Methodologies for Targeting High-Intent Travelers

To capture in-market (actively planning) and intended (showing interest) tourists, marketers can use these methodologies, powered by MEmob+ and AllPings:

- Audience Segmentation:

- Psychographic: Segment based on interests (e.g., foodies, shoppers) using MEmob+’s behavioral data. For example, target “culinary travelers” searching “Moroccan cuisine” or “luxury shoppers” engaging with “Dubai mall deals.”

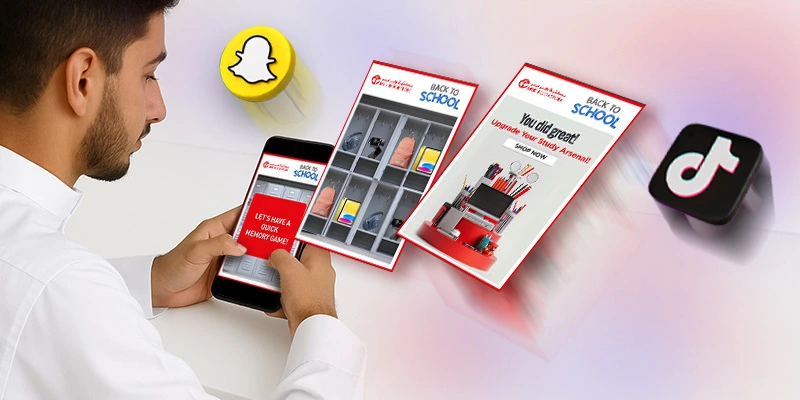

- Technographic: Identify users on travel apps (e.g., Booking.com) or social platforms (e.g., TikTok), leveraging AllPings’ app usage tracking.

- Geographic: Use AllPings’ heatmaps to pinpoint high-traffic zones like malls, airports, or event venues (e.g., Riyadh Season).

- Demographic: Focus on affluent travelers (e.g., 25–45 years, high income) using MEmob+’s demographic filters.

- Real-Time Geofencing:

- Deploy AllPings’ geofencing to deliver ads when travelers enter high-intent locations (e.g., DXB airport, Dubai Mall). For instance, a hotel ad for “5-star stays in Greece” targets travelers at airport lounges.

- Example: During Dubai Summer Surprises 2024, AllPings geo-fenced malls, delivering retail ads that drove 40% higher engagement (AllPings case study).

- Geofarming for Retargeting:

- AllPings’ geofarming captures data on past visitors to destinations. Retarget these audiences with tailored ads, increasing conversion likelihood by 65% (AllPings data).

- Example: A travel agency retargeted GCC visitors to Spain with “exclusive Barcelona tours,” boosting bookings by 25%.

- Personalized Ad Creative:

- Use MEmob+’s dynamic creative optimization to tailor ads to segments. For foodies, highlight “culinary tours in Morocco”; for families, promote “kid-friendly Swiss resorts.” A/B test visuals to optimize click-through rates.

- Example: A QSR’s ad for “Iftar-inspired meals” during Ramadan 2024, tailored via MEmob+, saw a 70% conversion uplift (prior conversation, March 10, 2025).

- UniChannel Delivery:

- Distribute ads across META, Snapchat, TikTok, and in-app display using MEmob+’s DSP. AllPings’ real-time tracking ensures optimal ad frequency, reducing waste and boosting ROAS by 50% (Kody Technolab).

- Predictive Analytics:

- MEmob+’s AI predicts travel intent by analyzing search patterns (e.g., “Greece visa-free travel”) and app usage. AllPings’ mobility data forecasts peak travel times, enabling proactive ad placement.

- Example: A hotel chain used MEmob+’s predictive models to target UAE travelers planning summer trips, achieving a 45% higher booking rate.

Tailoring Ads for Higher Conversion Intent

To guide travelers from interest to purchase, align ads with the customer journey:

- Awareness: Use vibrant TikTok ads to capture attention. AllPings’ mobility data identifies trending destinations for ad focus.

- Consideration: Deliver targeted ads via MEmob+’s DSP, such as “Book your Greece villa now” to users searching travel apps. 75% of GCC consumers act on location-based ads within hours.

- Conversion: Geo-fence high-intent locations (e.g., airports) with urgency-driven ads like “Last chance: 10% off flights to Spain.” AllPings’ analytics track conversions in real-time.

- Retention: Retarget past travelers with loyalty offers (e.g., “Return to Morocco with 15% off”) using AllPings’ geofarming.

Measuring and Optimizing Campaigns

MEmob+ and AllPings provide AI-powered analytics to track performance:

- Demographics: Age, nationality, interests (e.g., food, shopping).

- Behavior: App usage, search keywords, foot traffic.

- Outcomes: Click-through rates, conversions, ROAS.

- Optimization: Adjust ad frequency or creative based on real-time data, improving viewability by 60% (Screaming Frog).

Why MEmob+ and AllPings Are Your 2025 Edge

MEmob+’s AdTech and AllPings’ location intelligence transform summer 2025 into a conversion powerhouse. By segmenting audiences, geo-fencing high-intent zones, and delivering personalized ads, brands across hospitality, retail, aviation, QSR, and entertainment can capture GCC travelers’ $2,000–$3,500 budgets.

Sources:

- IMARC Group: GCC Outbound Tourism Market

- UNWTO: World Tourism Barometer 2024

- Statista: GCC Tourism Spending 2024

- Sabre: 2025 Travel Trends

- Connecting Travel: GCC Outbound Report 2024

- Fortune Business Insights: Ecotourism Market 2024

- Kody Technolab: Travel Tech Trends 2025

- Roland Berger: Saudi Tourism Outlook 2024

- GlobalData: GCC Tourism Insight 2025

- AllPings: Location Intelligence Case Studies

- MEmob+: AdTech Case Studies